Dynamics Receivables Management gives you effective control over your accounts receivable. By automating the processes you need to efficiently manage sales made on account, Receivables Management will help you track customers, manage invoices, process receipts and analyze customer activity.

Dynamics Receivables Management works seamlessly with the other Dynamics modules, such as Invoicing and Sales Order Processing for order entry, Multicurrency for multinational sales, Bank Reconciliation for cash management, and the Dynamics electronic commerce applications, eView, and eOrder.

As part of Dynamics, the industry’s leading accounting solution for Microsoft Windows XP and Windows NT, Dynamics Receivables Management delivers unparalleled access to decision-driving information, turning data into a powerful competitive weapon. Dynamics’ proven track record for delivering the latest and best technologies to customers first ensures you get an outstanding return on investment now, and be perfectly positioned for rapid growth and change. And Microsoft Great Plains Software’s legendary commitment to customer support means we’ll be at your side, whenever you need us.

Unparalleled access to decision driving information gives your business a superior competitive advantage

Receivables inquiries: Get instant answers to your sales, payment and customer activity questions. Receivables Management enables you to view unposted, posted and historical transactions, plus complete customer, period sales, yearly sales, payment history, and receivables summary information, with up-to-the-minute accuracy.

Drill downs: Easily locate the underlying information you’re most interested in. Drill downs can also cross modules, so sales activity can be followed back to the invoice on which it was first recorded in Sales Order Processing.

|

Dynamics’ cross-module drill down capabilities enable you to follow an electronic audit trail back from General Ledger to the originating transaction, giving you the answers you need in seconds and improving your ability to satisfy your customer. |

Rich reporting capabilities provide in-depth activity tracking and analysis

Receivables Management reports: Analyze all facets of your sales activity with comprehensive reports that can be sorted by calendar or fiscal year, enabling you to see totals per customer at calendar year end for reporting requirements, as well as at fiscal year end for your analysis.

Aged Trial Balance and Historical Aged Trial Balance: Review current and prior period aging, specifying ending dates for exact control of information.

Report options: Create a suite of reports that present the information you need in the best format for your business. You can save multiple versions of each report, and group reports for consistent analysis.

On-screen reporting: Quickly print any report to your screen and electronically search for specific information you need.

Custom reports: For complete reporting flexibility and power, the Dynamics Report Writer and Crystal Reports Professional enable you to modify existing reports or create entirely new reports, including graphing capabilities and the ability to export data to spreadsheets and other applications.

Reprint posting journals: Instantly recreate posting information for audit review or in case paper journals are lost or damaged.

Delivering the power of the Internet to your business

Extend the reach of your information: Employees throughout your organization can receive accurate and up-to-date inventory information, without having to have access to the accounting system. Dynamics eView provides business intelligence by securely connecting your Dynamics information with the Internet.

Customer views: Instantly check customer card information, plus aging, finance charge, credit risk and sales summary information to quickly answer questions and make informed decisions.

Sales views: Annual, calendar and fiscal year sales activity are just a click away with eView, plus you can see summary and detail information on customer sales and returns.

Dynamics reports: Post any or all Dynamics reports online through eView for electronic distribution of the vital information you use to run your company.

Receivables Management helps build a foundation of information for your sales process

Comprehensive customer tracking gives you the information you need to improve sales and customer service.

Customer information: Improve customer service by collecting customer address, phone, fax, e-mail, shipping, tax, payment terms, price level, finance charge, credit limit, credit card and complete history information.

Unlimited addresses for each customer: Accommodate the specific needs of each customer by entering separate Primary, Ship To, Bill To and Statement To addresses. You can add or change address information at any time.

User-defined information: Customize your records by specifying information unique to your company in the user-defined fields on customer cards. For example, you can use the first field to sort reports, providing additional flexibility to analyze indicators specific to your business, and use the second field to record customers’ birthdays for sales contact.

Flexible history options: Keep extensive account history for customers with large accounts, while summarizing account activity for others by designating calendar and fiscal periods for each customer, along with transaction and distribution history by defining record history options.

Notes added to records: Easily access information about a customer by adding “notes” to individual customer and transaction records.

Streamlined customer recording process saves time and improves consistency

Customer classes: Define unlimited classes to categorize customer information, providing a fast and consistent method for entering new customer records. For example, you can set up customer classes by geographic region. When you select a class for a new customer record, much of the customer record’s details such as credit limits, shipping methods and posting accounts will be entered automatically for you.

Individual customer or class changes: Change information specific to an individual customer’s record or change a field in a customer class to “roll down” the change to all customers in that class. To change class information, you need only enter the change once to update all the customer records in that class.

Salesperson tracking: Set up records for each salesperson and Receivables Management tracks commissions, commissioned sales, non-commissioned sales and cost of sales for the year-to-date and last year.

Sales territory tracking: Assign salespeople to territories, and compare performance between sales territories to track trends and analyze performance.

|

Track the performance of your salespeople and

territories easily within Dynamics Salesperson and Territory Maintenance. |

Time saving data entry procedures increase office productivity

Defaults: Take advantage of information entered on the customer card and throughout Dynamics to increase data entry speeds. Defaults include customer and salesperson information, sales taxes, currencies, payment terms, credit card information, distribution accounts and more.

Sales taxes: Easy and flexible tax setup procedures enable Dynamics to track state, local, VAT, GST and other taxes automatically.

Review credit limits: Review customer credit information while entering transactions. The convenience of having customer information easily available helps make processing transactions quicker and more accurate.

Cash receipts: While entering cash receipts, easily locate invoice information to be applied to the receipts. All you need is the customer ID or invoice number.

Non-sufficient fund (NSF) checks: Efficiently manage accounts affected by NSF checks. Checks returned because of non-sufficient funds can be easily recorded and tracked. Also, when you mark a check as NSF, you have the additional option of posting an NSF charge to the customer’s account.

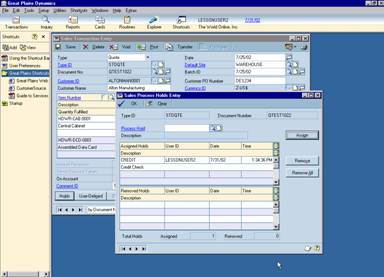

Customer holds: Place customer accounts on hold, temporarily preventing additional sales to the affected account, while allowing you to enter cash receipts.

Void transactions: You can easily void transactions while you maintain a complete and accurate audit trail of every voided transaction. Invoices are voided with a single click-all reversing entries are made automatically, including updating the customer record and General Ledger.

Multicurrency: Handle transactions in any currency with Dynamics Multicurrency Management. Enter receivables transactions in their originating currency, and when a cash receipt is applied to a sale, a realized gain or loss will be calculated automatically to account for changes in the exchange rate. All multicurrency documents will be listed in the credit document’s currency, allowing you to see the exact amount being applied to the credit balance.

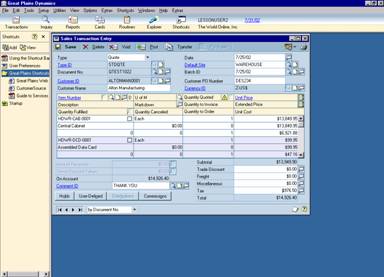

|

Transaction entry in Receivables Management is

swift and efficient, with numerous defaults to speed data entry. And cash

receipts can be entered with the invoice, or separately and applied to

individual invoice or an outstanding balance.

|

“Routine procedures” enable you to define your process and follow it faithfully

Routine checklists: Define the business processes that you complete on a routine basis, and ensure all steps are completed in their proper order. Dynamics enables you to create on-line “to-do” lists that lead users through the appropriate steps, and that record the user name, date and time for each step.

Statement cycles: Typical steps include aging, calculating finance charges, printing statements, transferring commissions and removing paid transactions to history. To this you can add backup procedures and scheduled analysis report printing. Tasks can be added, removed and reordered on the checklist, and you can include external applications on your checklist, such as spreadsheets for analysis or word processing for mail merge capabilities.

Transaction Rollback and Recovery

If you choose to run Dynamics Receivables Management on a Microsoft SQL Server Database, you’ll be able to include transaction rollback and recovery for select procedures. If a transaction is interrupted by a system crash such as a loss of power, you can rollback transactions, enhancing data integrity and reducing re-entry of lost data.

Lockbox Processing

Lockbox processing is a new module, separate from Receivables Management, that automatically applies customer payment information from a transaction file provided by the customer's bank. No longer is the administration associated with managing cash receipts a cumbersome, manual task, but rather is processed with an electronic batch that is compiled by any banking institution and sent to Dynamics for transacting within Receivables Management.

CompuAll, Incorporated Quality

Solutions Since 1985

10061 Talbert Avenue #200

Fountain Valley, California 92708 USA

Phone: (714) 964-2140 Fax: (714) 964-1491

For a demo or more information E-Mail us at

info@compuall.net for more information.